That’s because Brigit acts even more as a private financing application of which enables you earn earnings by implies of gigs. The Funds Software advance loan function will be an excellent add-on to become capable to the particular application for users who else want money today. Additionally, learning how in buy to borrow cash app borrow funds on Funds Application is simple plus shouldn’t end up being as well complex also with regard to non-tech-savvy users. Nevertheless, right now there are usually several phrases in add-on to circumstances an individual require in order to realize concerning the characteristic before you begin borrowing money.

- Thus if “Borrow” doesn’t appear on the house screen or typically the “Banking” page, you’re most likely ineligible.

- Funds Software does not execute a tough credit rating examine about prospective borrowers, which indicates your current credit rating rating may’t be negatively affected basically simply by using regarding a financial loan through Cash Application.

- Whilst the particular business practically certainly checks your credit report, that’s possibly all it can.

- Become aware that will when an individual don’t pay back again upon time, there’s a one.25% late payment every week.

- These Sorts Of programs permit you to be in a position to borrow against your current next salary with lower interest prices and fees in comparison in buy to personal loans, payday loans and credit rating playing cards.

Exactly What Will Be The Money Software Borrow Feature?

Typically The info infringement emerged coming from a former worker who else downloaded reports that contains customer titles, brokerage bank account figures in addition to, within some situations, profile beliefs in add-on to trading info. It’s not really yet very clear exactly how widely typically the info was contributed or typically the damages faced simply by customers.For a great deal more information on exactly how Cash Software works, check out the Money App overview. Check out there the guideline to end upward being able to video games of which pay immediately to Money App to become capable to learn even more. Money Software loans are short-term, therefore they will can become a whole lot even more expensive compared to loans with extended phrase measures. Lenders realize as much as a person do that a person want typically the funds quickly, therefore it’s a fee regarding convenience more compared to anything at all else.

Five Basic Actions To Enhance Finances

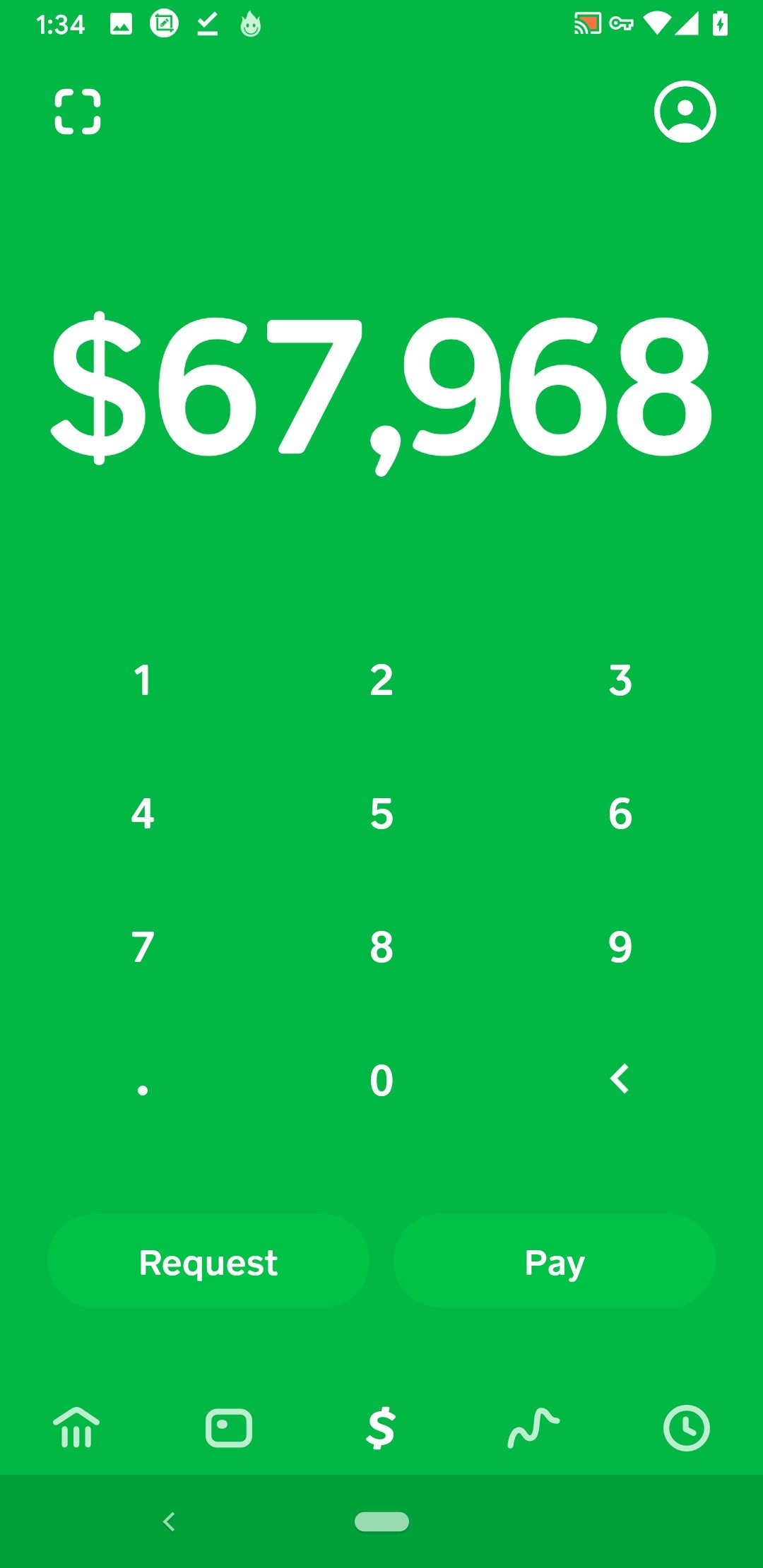

It’s free to become capable to use, nevertheless right now there are charges for specific dealings, for example sending cash using a credit credit card. When you possess a Cash Application accounts, a person can accessibility Funds Application Borrow by simply proceeding in buy to typically the Bank case in add-on to picking the Borrow alternative. If you’re eligible, you’ll end upward being in a position to select a loan sum plus repayment conditions of which work regarding a person. Funds Software provides totally changed the particular method we manage private finances, providing a variety regarding easy functions beyond peer-to-peer repayments. 1 this type of characteristic is the particular capacity to end upwards being in a position to borrow cash straight coming from the software. Whether Or Not you need funds regarding a good unexpected expense or to become able to bridge a monetary space, understanding exactly how to be capable to borrow money coming from Money App could offer a fast and effortless remedy.

Cash Software Borrow Repayment Construction

CoinCodex paths 40,000+ cryptocurrencies on 400+ deals, providing survive prices, value forecasts, in add-on to economic resources with consider to crypto, stocks, in add-on to forex investors. I’m at present at $325.They Will boost it $25 every single few occasions following a person pay it away from. Views expressed right here usually are typically the author’s only, not individuals of any kind of bank or economic organization. This articles offers not really already been examined, accepted or otherwise endorsed by simply any kind of of these sorts of entities. Performed you or somebody a person really like obtain a notice from RIP Healthcare Debt? Were a person suspicious about whether the particular debt had been truly forgiven?

Within add-on to comprehending typically the interest plus costs, understanding along with repayment conditions is crucial. Early repayments might result within decreased interest, nevertheless verify this particular with Money App in buy to guarantee a person understand just how finest in buy to manage your financial loan. Funds App Borrow gives some useful features regarding qualified customers. Regarding anybody that may possibly need a quick increase in buy to their particular funds movement to include unexpected costs, Cash App Borrow can become somewhat of a life-saver.

Additional Choices To Funds Software Borrowing

A Person will not be capable to take out a new one unless of course you’re done having to pay. Yes, several declares perform permit lenders to expand a “rollover” deal with a consumer. This Specific implies you’ll only have got in order to pay the fees that will usually are because of and your repayment time period becomes an expansion. On One Other Hand, this particular furthermore means you’ll end upward spending a lot more and remaining inside debt regarding extended.

- Previously, the lady had been Well+Good’s Way Of Life Writer and worked at Typically The Wa Post on typically the lifestyle desk inside typically the features segment.

- Several lenders upon PockBox specialize in borrowers with poor credit, thus even when you’ve recently been flipped down in other places, an individual might continue to meet the criteria regarding a mortgage.

- Furthermore, the particular program is forthright regarding its partnership with credit rating bureaus.

There usually are likewise zero banking services just like credit rating or charge cards, thus you’re not likely in buy to get even more debt. Nevertheless, you carry out require in order to enroll just before you can consider out a financial loan. However, the particular phrases will stay the exact same regardless regarding typically the quantity. You need to pay the particular primary in inclusion to the particular 5% flat charge inside 4 days. Late payments will get an additional just one.25% payment after having a one-week grace time period.

When an individual go also long with out repaying typically the mortgage, a person may possibly endure added effects about best associated with these types of charges. That’s why choices such as Coronary Heart Paydays can end upwards being a godsend, providing adaptable, quick, in add-on to comprehensive loan alternatives regarding individuals that don’t qualify regarding Money App loans. Here’s everything you require to know concerning borrowing cash by indicates of Funds Software in add-on to their top alternatives.

Just How Cellular Sdk Would Certainly Far Better Affect Financial Loan Selections

Above the course associated with 13 months, this particular adds upward to end upwards being in a position to 60% complete, nevertheless that’s nevertheless fewer compared to you’d pay when you got out there a payday mortgage. In Purchase To borrow funds through Money Software, an individual require in order to be generating normal deposits into your Funds App accounts. Typically The more an individual frequently downpayment, the even more an individual can borrow coming from Funds Software. With Consider To illustration, adding $300 each 30 days will permit a person to borrow around $70.